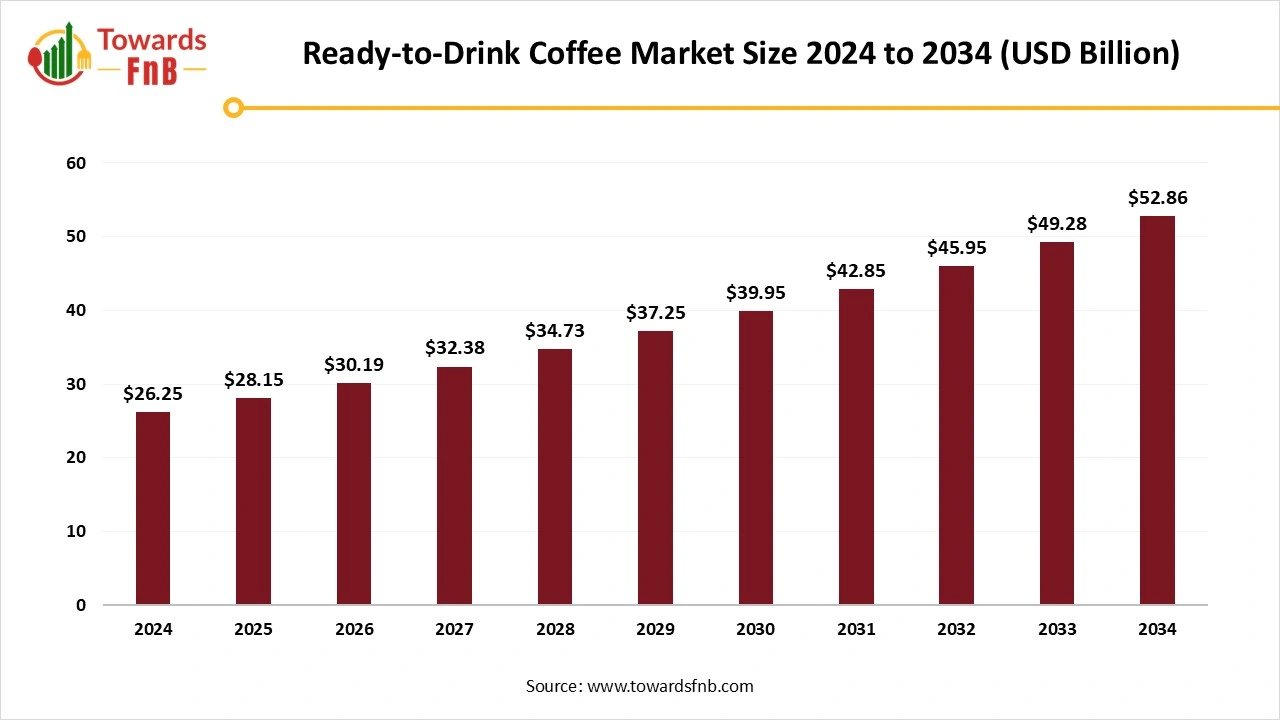

Ready-to-Drink Coffee Market Size Worth USD 52.86 Billion by 2034

According to Towards FnB, the global ready-to-drink coffee market size is calculated at USD 28.15 billion in 2025 and is forecasted to reach around USD 52.86 billion by 2034, growing at a CAGR of 7.25% during the forecast period from 2025 to 2034. Key factors such as the rise of on-the-go lifestyles, the popularity of cold brew and functional beverages, and sustainability trends are fueling this growth across regions like Asia Pacific and North America.

Ottawa, Aug. 19, 2025 (GLOBE NEWSWIRE) -- The global ready-to-drink coffee market size accounted for USD 26.25 billion in 2024 and is predicted to grow form USD 28.15 billion in 2025 to around USD 52.86 billion by 2034, expanding at a CAGR of 7.25% from 2025 to 2034, according to study published by Towards FnB, a sister firm of Precedence Research.

The ready-to-drink coffee market is observing a huge spike in recent periods due to high demand for specialty coffee, premium coffee, on-the-go beverages, and convenient drinks to manage hectic schedules. The Gen Z and millennials form a huge consumer base for the growth of the ready-to-drink coffee market.

Note: This report is readily available for immediate delivery. We can review it with you in a meeting to ensure data reliability and quality for decision-making.

Access the Full Study Instantly | Download Sample Pages of the Report Now@ https://www.towardsfnb.com/download-sample/5789

RTD coffee is transitioning from occasional purchase to habitual consumption, with <5g sugar and protein-added SKUs gaining repeat buys. Value multipacks in convenience and online channels are contributing to broader household penetration over the next 12–24 months, said Vidyesh Swar, Principal Consultant at Towards FnB.

Market Overview

The ready-to-drink coffee market refers to the manufacturing, packaging, and distribution of ready-to-drink coffee without any further preparation. The convenient coffee option is helpful for people with hectic schedules. The market allows such consumers to grab their coffee of the day easily from different retail platforms, allowing the growth of the market. Such coffees are available in different packaging formats such as cans, bottles, and cartons to maintain the sustainability factor. Such convenient packaging also helps consumers to carry their coffee easily on the go without disturbing their busy schedules. Innovative flavors and brews also help the market grow by catering to the growing needs of consumers.

Key Highlights of the Ready-to-Drink Coffee Market

- By region, Asia Pacific dominated the global ready-to-drink (RTD) coffee market in 2024, generating the highest revenue share, and is expected to maintain its growth from 2025 to 2034 due to a higher youth population.

- By region, North America is anticipated to grow at a significant CAGR from 2025 to 2034, driven by the increasing presence of e-commerce.

- By product type, the cold brew coffee segment accounted for the largest revenue share of 30% in 2024, thanks to its smoother, less bitter taste.

- By product type, the functional RTD coffee segment is expected to experience the fastest CAGR from 2025 to 2034, driven by growing health consciousness.

- By packaging, the bottles segment held the largest revenue share of 32% in 2024, owing to their convenience and portability.

- By packaging, the cartons segment is expected to grow at the fastest CAGR from 2025 to 2034, influenced by its appeal as a sustainable option.

- By cream content, the dairy-based segment accounted for the largest revenue share of 70% in 2024, due to its broader cultural acceptance.

- By cream content, the plant-based segment is forecast to grow at the fastest CAGR from 2025 to 2034, driven by the rising trend of veganism.

- By sweetener type, the regular sugar segment captured the largest revenue share of 55% in 2024, due to its wider availability in products.

- By sweetener type, the sugar-free segment is expected to grow at the fastest CAGR during the forecast period from 2025 to 2034, fueled by increasing health awareness.

- By distribution channel, the supermarkets/hypermarkets segment held the highest revenue share of 38% in 2024, owing to the wide availability of products.

- By distribution channel, the online retail segment is projected to grow at the fastest CAGR from 2025 to 2034, driven by the rise in smartphone penetration.

New Trends of the Ready-to-Drink Coffee Market

- The hectic lifestyles of people due to rapid urbanization are one of the major reasons for the growth of the market. Such coffees are highly preferred by people who do not have time to enjoy their coffees while seated in a café or to prepare them at home.

- The growing Gen Z population is another major reason for the growth of the market. The generation likes to explore cafes and is also health-conscious, further fueling the demand for the market.

- Consumer awareness regarding sustainable packaging is also one of the major reasons for the growth of the market for ready-to-drink coffee. Consumers prefer brands that provide convenient coffees in sustainable packaging rather than those offering traditional packaging.

How Has AI Benefitted the Ready-to-Drink Coffee Market?

Artificial intelligence (AI) has significantly benefited the ready-to-drink coffee market by optimizing product innovation, consumer engagement, and operational efficiency. With shifting consumer preferences toward convenience and healthier beverage options, AI-powered analytics help manufacturers analyze vast datasets on taste trends, ingredient preferences, and lifestyle patterns to develop new RTD coffee flavors, formulations, and functional blends that resonate with diverse demographics. AI also supports personalization in marketing by enabling brands to design targeted campaigns and recommendation engines that connect consumers with products based on purchase history, dietary needs, or even time-of-day consumption habits. In e-commerce, AI-driven predictive tools enhance demand forecasting, inventory management, and dynamic pricing strategies, ensuring better product availability while reducing costs and waste.

Operational focus: common applications include short-term demand forecasting, inventory allocation, promotion response analysis, and claim/performance testing for new SKUs.

Recent Developments in the Ready-to-Drink Coffee Market

- In August 2025, Prefer, a Singapore-based startup, launched its new soluble bean-free coffee and cocoa powders. The main aim of the launch is to navigate the higher prices and shrinking supplies of the sought-after commodities. (Source- https://agfundernews.com)

- In February 2025, Nestlé S.A. announced the plan to sell Starbucks, Ready-to-Drink coffee, and beverages outside the café. (Source- https://www.business-standard.com)

View Full Market Intelligence@ https://www.towardsfnb.com/insights/ready-to-drink-coffee-market

Case Study: Starbucks’ 2025 U.S. RTD Coffee Launch—Functional and Lower-Calorie Lines, Immediate Grocery and Convenience Rollout

Background:

On March 27, 2025, Starbucks announced two new ready-to-drink lines, RTD Starbucks Iced Energy and RTD Starbucks Frappuccino Lite with immediate rollout to U.S. grocery and convenience stores. The products were developed via the long-running North American Coffee Partnership (NACP) with PepsiCo, aligning with category demand for functional (energy) and lower-calorie options.

Solution:

Starbucks structured its announcement around three editor-friendly elements:

- Clear consumer benefits in the product names and copy (energy positioning; “Lite” with calorie reduction), plus concrete specs (e.g., flavors and calorie/caffeine details).

- Immediate channel proof (“rolling out now” to grocery and convenience) to signal scale and near-term availability.

-

Credible distribution partner named in paragraph one (PepsiCo via NACP) to reassure trade media on execution.

Outcome:

The announcement secured rapid pickup across trade and consumer outlets, including QSR Magazine, VendingConnection, and Allrecipes, each repeating the functional/low-calorie angles and the channel rollout, creating consistent messaging and multiple backlinks to the launch.

Market Dynamics

What Are the Growth Drivers of the Ready-to-Drink Coffee Market?

Multiple growth factors have aided the growth of the ready-to-drink coffee market in recent times. Convenience is one of the major factors for the growth of the market. People with hectic schedules and no time to prepare have coffee in a café or restaurant, and prefer to pick convenient options available in convenient packaging. It helps them to save their time and also allows them to enjoy their coffee on the go. Sustainable packaging is another major factor for the growth of the market for ready-to-drink coffee. Convenient coffees available in sustainable packaging are highly preferred by consumers rather than those with traditional plastic packaging. Innovative flavors and coffee brews are also helping to attract customers to help enhance the growth of the market.

Restraint

Lower Coffee Preference may also hamper the Growth of the Market

Many rural regions of Asia and Africa still prefer tea more than coffee. Hence, the sale of coffee-based beverages in such areas acts as a restraint on the growth of the ready-to-drink coffee market. People in such areas may also not prefer to buy such beverages, further disturbing the market’s growth. Lower demand leading to lower supply of such convenient coffee options in such areas lowers the growth of the market.

Opportunity

High Demand for Sugar-Free Coffee is helping the Growth of the Market

Rising health conditions such as obesity, diabetes, and cholesterol are leading to lower sugar consumption by the majority of the population. Hence, higher demand for sugar-free coffee and coffee-based products is observed, leading to the fueling of the ready-to-drink coffee market. Brands providing sugar-free coffee or coffee-based beverages are highly preferred by consumers, helping the growth of the market.

Ready-to-Drink Coffee Market Regional Analysis

Asia Pacific Dominated the Ready-to-Drink Coffee Market in 2024

Asia Pacific led the ready-to-drink coffee market in 2024 due to the high demand for the beverage in the region. The demand is hiked up mainly due to Gen Z and millennials highly preferring coffee and coffee-based beverages, helping the growth of the market. Countries such as India, China, Japan, and South Korea have a major contribution to the growth of the market in the region. The ready-to-drink coffees are highly popular in the region due to their convenience and cost factor, ideal for Gen Z to afford.

North America Is Expected to Grow the Fastest in the Forecast Period

North America is expected to grow in the foreseeable period, helping the growth of the ready-to-drink coffee market. Rising culture of coffee consumption, rising health consciousness, and high demand for ready-to-drink coffee by Gen Z are some of the major factors for the growth of the market in the region. A fast-paced lifestyle is also increasing the population’s preference towards the market, further helping in its growth as well. Countries like the US and Mexico play a huge role in the growth of the market in the region.

Ready-to-Drink Coffee Market Report Scope

| Report Attribute | Key Statistics |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Growth Rate from 2025 to 2034 | CAGR of 7.25% |

| Market Size in 2024 | USD 26.25 Billion |

| Market Size in 2025 | USD 28.15 Billion |

| Market Size by 2034 | USD 52.86 Billion |

| Dominated Region | Asia Pacific |

| Fastest Growing Region | North America |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Have Questions? Let’s Talk—Schedule a Meeting with Our Insights Team: https://www.towardsfnb.com/schedule-meeting

Ready-to-Drink Coffee Market Segmental Analysis

Product Type Analysis

The cold brew segment led the market for ready-to-drink coffee in 2024 due to its sweet taste, which is preferred by a huge chunk of the population. The younger generation, such as Gen Z and millennials, form a huge consumer group for the segment, further fueling the growth of the market. High demand for such coffees is another major factor for the growth of the market.

The functional RTD coffee segment is expected to grow in the foreseen period due to the rising population of health-conscious consumers, helping the growth of the market in the foreseen period. The fitness-conscious consumers prefer to consume healthy beverages rather than hard drinks, which aids the growth of the ready-to-drink coffee market in the foreseeable period. Hence, functional RTD drinks allow consumers to binge on health beverages on the go without the hassle of preparing them or waiting in a café for coffee.

Packaging Type Analysis

The bottle segment led the ready-to-drink coffee market due to its convenience factor, allowing consumers to carry their coffees easily on the go, aiding their hectic schedule. Adoption of reusable bottles in attractive shapes and designs is also attracting Gen Zs and millennials, which is another major factor for the growth of the segment and the market.

The carton segment is expected to grow in the foreseen period due to its sustainability factor, helping the growth of the ready-to-drink coffee market. Today’s environmentally oriented generation forms a huge consumer base for the brands supporting sustainable packaging. The materials used for the manufacturing of cartons are lightweight and cost-effective, further aiding the growth of the segment. Hence, the segment is expected to grow in the foreseen period, helping the growth of the market for ready-to-drink coffee.

Cream Content Type Analysis

The dairy-based segment led the ready-to-drink coffee market in 2024 due to the high preference for milk coffees due to their taste. Hence, it furthered the market of flavored coffees such as caramel, mocha, and various other flavored coffees. Easy availability of milk-based coffees in different flavors is another major factor for the market’s growth. Partnerships of the dairy segment with leading industry players are helpful for the product spread globally and are also helping the growth of the market.

The plant-based segment is expected to grow in the foreseen period due to the rising population of veganism or plant-based diet followers, helping the growth of the ready-to-drink coffee market. The segment is also expected to grow in the foreseen period due to increasing awareness about the health benefits of plant-based coffees, further fueling the growth of the market.

Sweetener Type Analysis

The regular sugar segment led the ready-to-drink coffee market in 2024 due to its high demand among the population. Easy availability of sugary coffees or their flavored alternatives is another major factor for the growth of the segment. The segment has also observed growth due to rising café culture among the millennials and Gen Z.

The sugar-free segment is expected to grow in the foreseeable period due to high demand for sugar-free beverages and food items. The rising prevalence of health issues such as obesity and diabetes has led the population to consume sugar-free beverages, further fueling the growth of the ready-to-drink coffee market. Hence, the segment is observed to grow in the foreseen period.

By Distribution Channel Analysis

The hypermarkets/supermarkets segment led the ready-to-drink coffee market in 2024 due to their high presence near residential areas, helping consumers to choose the required product easily. The management of the products, ideally in an attractive manner on a higher shelf, also aids in the growth. Hence, the segment led the market in 2024.

The online segment is expected to grow in the foreseen period due to its convenience factor and easy availability of required products at an affordable price. Availability of coupons and discounts attracts consumers further, helping the growth of the market. Consumers getting different types of coffees in different flavor options easily at their doorstep is another major factor helpful for the growth of the market in the foreseeable period.

Feel Free to Get in Touch with Us for Orders or Any Questions at: sales@towardsfnb.com

Additional Topics Worth Exploring:

- Alcoholic Drinks Market: The global alcoholic drinks market size is projected to expand from USD 1,934.86 billion in 2025 to USD 4,488.19 billion by 2034, growing at a CAGR of 9.80% during the forecast period from 2025 to 2034.

- Soft Drinks Market: The global soft drinks market size is projected to expand from USD 222.64 billion in 2025 to USD 280.50 billion by 2034, growing at a CAGR of 2.6% during the forecast period from 2025 to 2034.

- Probiotic Drinks Market: The global probiotic drinks market size is projected to expand from USD 26.96 billion in 2025 to USD 56.19 billion by 2034, growing at a CAGR of 8.50% during the forecast period from 2025 to 2034.

- North America Snack Bar Market: The North America snack bar market size is rising from USD 14.85 billion in 2025 to USD 30.17 billion by 2034. This projected expansion reflects a CAGR of 8.2% during the forecast period from 2025 to 2034.

- Wheat Protein Ingredients Market: The global wheat protein ingredients market size is projected to witness strong growth from USD 6.44 billion in 2025 to USD 9.33 billion by 2034, reflecting a CAGR of 4.2% over the forecast period from 2025 to 2034.

- Food Ingredients Market: The global food ingredients market size is projected to expand from USD 368.70 billion in 2025 to USD 567.09 billion by 2034, growing at a CAGR of 4.9% during the forecast period from 2025 to 2034.

- Micronized Salt Market: The global micronized salt market size is rising from USD 3,145.70 million in 2025 to USD 3,998.08 million by 2034. This projected expansion reflects a CAGR of 2.7% during the forecast period from 2025 to 2034.

- U.S. Maltodextrin Market: The U.S. maltodextrin market size is projected to witness strong growth from USD 1.44 billion in 2025 to USD 2.06 billion by 2034, reflecting a CAGR of 4.1% over the forecast period from 2025 to 2034.

Key Players in the Ready-to-Drink Coffee Market

- Nestlé S.A.

- Starbucks Corporation (through alliances like with PepsiCo/Nestlé)

- The Coca-Cola Company (including Georgia Coffee)

- PepsiCo Inc. (with Starbucks RTD coffee)

- Suntory Beverage & Food Limited

- Danone S.A.

- Keurig Dr Pepper Inc.

- Asahi Group Holdings Ltd.

- Lotte Chilsung Beverage Co.

- Illycaffè S.p.A.

- La Colombe Coffee Roasters (now part of Chobani)

- Califia Farms, LLC

- Monster Beverage Corporation

- Arla Foods amba

- Gujarat Co-Operative Milk Marketing Federation (Amul)

- Sleepy Owl Coffee

- Blue Tokai Coffee Roasters

- Rise Brewing Co.

- Kitu (Super Coffee)

- High Brew Coffee (part of Beliv)

Segments Covered in the Report

By Product Type

- Cold Brew Coffee

- Iced Coffee

- Espresso-Based RTD Beverages (Latte, Cappuccino, Mocha, Espresso, etc.)

- Flavored RTD Coffee

- Functional RTD Coffee (Protein-enhanced, Vitamin-fortified, Nootropic, etc.)

By Packaging

- Bottles (PET, Glass)

- Cans (Aluminium)

- Cartons (Tetra Pak)

- Pouches

- Other Packaging

By Cream Content

- Dairy-Based

- Plant-Based (Almond, Oat, Soy, Coconut, etc.)

By Sweetener Type

- Regular Sugar

- Reduced Sugar

- Sugar-Free

- Naturally Sweetened

- Artificially Sweetened

By Distribution Channel

- Supermarkets/Hypermarkets

- Convenience Stores

- Online Retail (E-commerce platforms, Company Websites)

- Foodservice Outlets (Cafes, Restaurants, Vending Machines)

- Speciality Food Stores

By Region

North America

- U.S.

- Canada

Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

Latin America

- Brazil

- Mexico

- Argentina

Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait

Thank you for exploring our insights. For more targeted information, customized chapter-wise sections and region-specific editions such as North America, Europe, or Asia Pacific—are also available upon request.

For Detailed Pricing and Tailored Market Report Options, Click Here: https://www.towardsfnb.com/price/5789

Feel Free to Get in Touch with Us for Orders or Any Questions at: sales@towardsfnb.com

Unlock expert insights, custom research, and premium support with the Towards FnB Annual Membership. For USD 495/month (billed annually), get full access to exclusive F&B market data and personalized guidance. It’s your strategic edge in the food and beverage industry: https://www.towardsfnb.com/get-an-annual-membership

About Us

Towards FnB is a global consulting firm specializing in the food and beverage industry, providing innovative solutions and expert guidance to elevate businesses. With an in-depth understanding of the dynamic F&B sector, we deliver customized market analysis and strategic insights. Our team of seasoned professionals is committed to empowering clients with the knowledge needed to make informed decisions, ensuring they stay ahead of market trends. Partner with us as we redefine success in the rapidly evolving food and beverage landscape, and together, we’ll navigate this transformative journey.

Web: https://www.towardsfnb.com/

Our Trusted Data Partners

Precedence Research | Statifacts | Towards Packaging | Towards Chemical and Materials| Nova One Advisor | Food Beverage Strategies |

For Latest Update Follow Us:

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.