Hospital Services Market Size Worth USD 24.17 Trillion by 2034 Driven by Expansion of Digital Health and Telemedicine

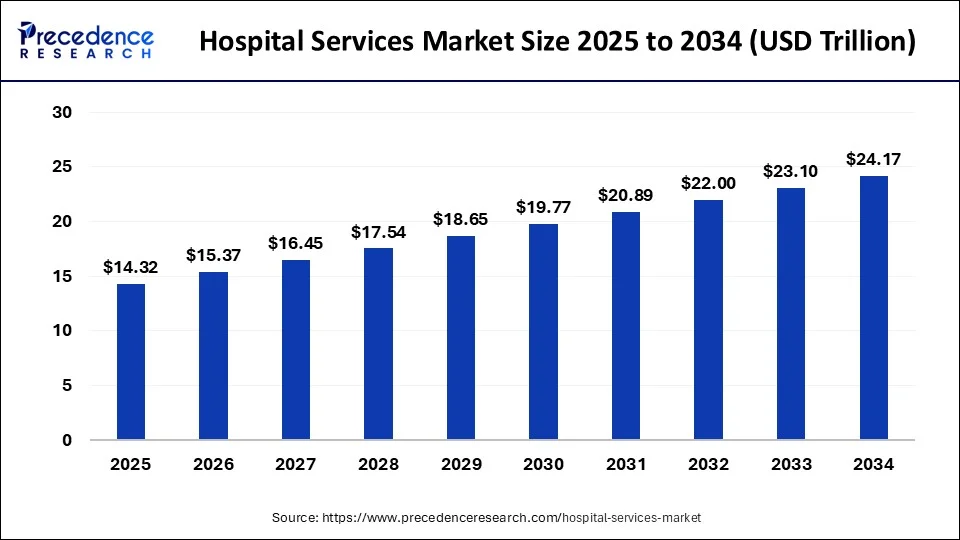

According to Precedence Research, the global hospital services market size will grow from USD 14.32 trillion in 2025 to nearly USD 24.17 trillion by 2034, with an expected CAGR of 5.99% from 2025 to 2034.

Ottawa, Nov. 26, 2025 (GLOBE NEWSWIRE) -- The global hospital services market size is expected to be worth over USD 24.17 trillion by 2034, increasing from USD 15.37 trillion in 2026, growing at a strong CAGR of 5.99% between 2025 and 2034. The hospital services market is driven by rising healthcare demand, technological advancements, and growing investments in infrastructure and patient care.

The Complete Study is Immediately Accessible | Download the Sample Pages of this Report@ https://www.precedenceresearch.com/sample/1082

Hospital Services Market Key Takeaways

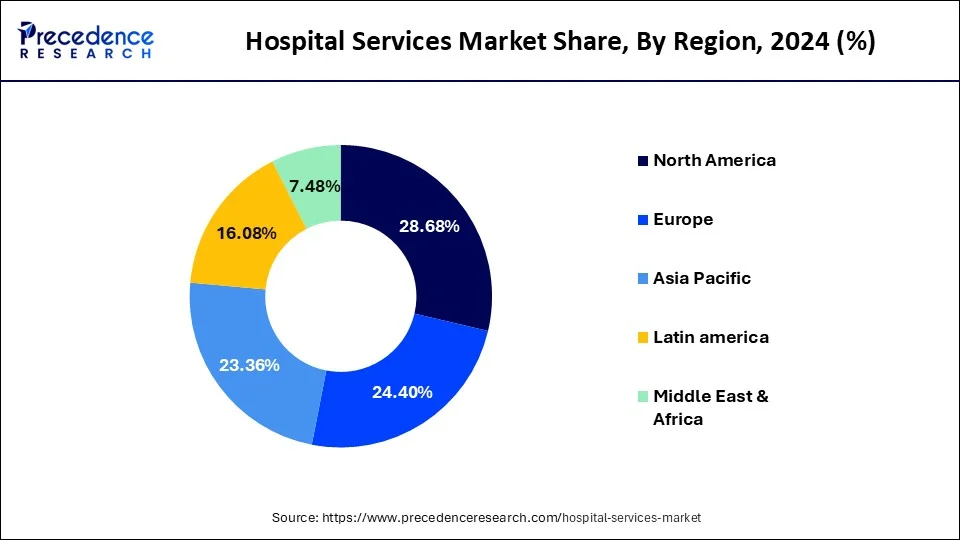

- North America dominated the global market, holding more than 28.68% of market share in 2024.

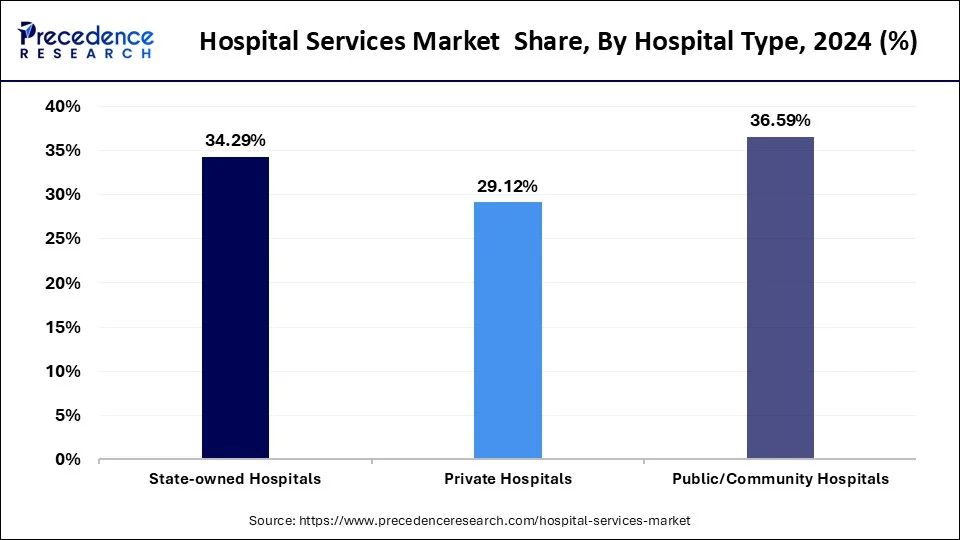

- By Hospital Type, the public/community hospitals segment held the major market share of 36.59% in 2024.

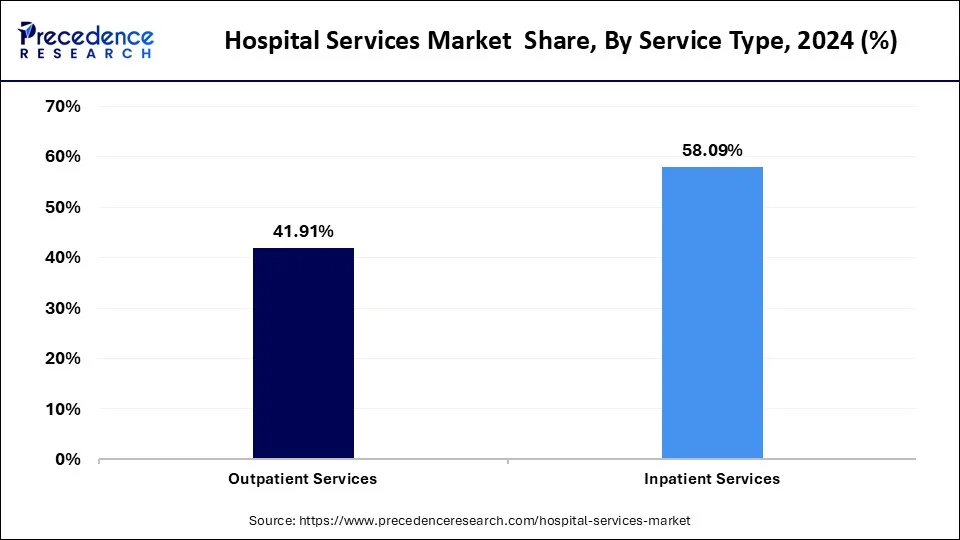

- By Service Type, the inpatient services segment contributed the largest market share of 58.09% in 2024.

- By Service Areas, the cardiovascular segment captured the biggest market share of 21.48% in 2024.

What are Hospital Services and What Does the Industry Hold?

The increasing rates of chronic diseases like diabetes, cardiovascular disorders, and cancer are one of the major sources of growth, as the cost of chronic diseases is high due to the necessity of constant medical attention and special medical treatment. Offered medical technology, particularly robotized surgeries, high-tech imaging, and precision medicine, is enhancing the quality of medical services and is attracting more patients to the hospital.

Furthermore, the digital health solutions, such as electronic health records (EHRs), AI-based diagnostic technologies, and telemedicine, are contributing to workflows and improving patient outcomes. The increasing investments by governments and private players in healthcare and the development of infrastructure in developing countries are also contributing to the market growth and the availability of hospital services in the global market.

➡️ Become a valued research partner with us https://www.precedenceresearch.com/schedule-meeting

Hospital Services Market Size, by Hospital Type, 2022 to 2024 (USD Billion)

| Hospital Type | 2022 | 2023 | 2024 |

| State-owned Hospitals | 3,904.9 | 4,227.8 | 4,561.6 |

| Private Hospitals | 3,270.0 | 3,565.2 | 3,873.3 |

| Public/Community Hospitals | 4,184.2 | 4,521.0 | 4,868.0 |

Hospital Services Market Size, by Service Type, 2022 to 2024 (USD Billion)

| Service Type | 2022 | 2023 | 2024 |

| Outpatient Services | 4,677.5 | 5,115.8 | 5,575.3 |

| Inpatient Service | 6,681.6 | 7,198.2 | 7,727.5 |

Hospital Services Market Size, by Service Areas, 2022 to 2024 (USD Billion)

| Service Areas | 2022 | 2023 | 2024 |

| Cardiovascular | 2,473.3 | 2,663.1 | 2,857.5 |

| Acute Care | 483.0 | 524.3 | 567.1 |

| Cancer Care | 1,633.1 | 1,774.9 | 1,922.3 |

| Diagnostics and Imaging | 1,799.9 | 1,953.5 | 2,112.9 |

| Neurorehabilitation & Psychiatry Services | 1,402.1 | 1,953.5 | 1,656.2 |

| Gynecology | 624.4 | 675.2 | 727.7 |

| Others | 2,943.4 | 3,196.4 | 3,459.2 |

Note: This report is readily available for immediate delivery. We can review it with you in a meeting to ensure data reliability and quality for decision-making.

Immediate Delivery Available | Buy This Premium Research Report@ https://www.precedenceresearch.com/checkout/1082

Key Market Trends in the Hospital Services Market

The hospital services market is primarily driven by demographic shifts such as aging populations and the rising prevalence of chronic diseases, which increase the demand for both acute and long-term care. Technological advancements, including AI-powered diagnostics, minimally invasive procedures, and telemedicine, are transforming patient care by enabling faster, more accurate diagnosis and expanding access, especially in remote areas. Additionally, growing private health insurance coverage and government healthcare initiatives are fueling investments in hospital infrastructure and service quality, further boosting market growth.

Emerging trends in the market include a strong shift toward outpatient and ambulatory care services, as patients and providers seek cost-effective, convenient alternatives to traditional inpatient treatment. The rise of digital health platforms and data-driven healthcare management is enhancing operational efficiency and personalized care delivery.

✚ Turn AI disruption into Opportunity. Click to Get the Insights Shaping Tomorrow.

Hospital Services Market Opportunity

Adoption of Next-gen Solutions:

Availability and adoption of next-generation stents are one of the key opportunities in the market of hospital services. As the occurrence of cardiovascular diseases is on the increase across the globe, there is a growing need to have a minimally invasive procedure like angioplasty. The next generation stents, such as bioresorbable and drug-eluting stents, have great benefits over the old ones as they lessen the likelihood of restenosis, enhance healing, and improve the outcome of the patient in the long term.

Using these advanced devices, the hospitals will be able to offer safer and better treatment options, which will attract more patients who require specialized care for the heart. Also, the increased investments in the research and development of stent technologies provide an opportunity to add innovative solutions to hospital services.

➤ Get the Full Report @ https://www.precedenceresearch.com/hospital-services-market

What is the Limitation for the Hospital Services Market?

One of the weaknesses of the market is that surgical procedures are very expensive and usually create a financial strain on patients. Although most people can be covered by insurance, not all conditions, especially pre-existing diseases, are covered. In these instances, the patients have to shoulder the costs and cannot access the required surgical treatment.

The increasing prices of the sophisticated medical equipment, surgical apparatus, and post-surgery services add to the total cost of the hospital procedures. Thus, hospitals are also faced with the challenge of providing quality care and being cost-effective, whereas governments and private insurers struggle to reach out to more people and make surgical care more affordable.

Hospital Services Market Report Scope

| Report Attribute | Key Data |

| Market Size in 2025 | USD 14.32 Trillion |

| Market Size in 2026 | USD 15.37 Trillion |

| Market Size by 2034 | USD 24.17 Trillion |

| Growth Rate (2025–2034) | CAGR of 5.99% |

| Largest Region (2024) | North America – ~28.68% market share |

| Fastest Growing Region | Asia-Pacific |

| Leading Hospital Type Segment (2024) | Public / Community Hospitals – ~36.59% share |

| Leading Service Class Segment (2024) | Inpatient Services – ~58.09% share |

| Leading Service Area Segment (2024) | Cardiovascular Services – ~21.48% share |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Service Class, Hospital Type, Service Area, Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Key Growth Drivers | • Rising prevalence of chronic and lifestyle diseases • Expansion of digital health, telemedicine, and EHR adoption • Growing number of surgical procedures (e.g., orthopedic, cardiovascular) • Higher healthcare spending and insurance coverage • Advancements in medical technologies and hospital infrastructure |

| Key Restraints | • High treatment and hospitalization costs • Limited access to advanced care in rural/low-income regions • Workforce shortages and rising operational expenses |

| Market Opportunities | • Growing demand for specialized tertiary care services • AI-driven diagnostics and robotic surgeries • Increased investment in smart hospitals and integrated care systems • Expansion of value-based care and outcome-driven hospital models |

Immediate Delivery Available | Buy This Premium Research Report@ https://www.precedenceresearch.com/checkout/1082

Case Study: Digital Transformation Improved Patient Care & Operational Efficiency in a Multi-Hospital Network

Background

A leading 12-hospital network in the U.S. faced rising patient load, longer waiting times, increasing operational costs, and staff shortages after the pandemic. The network needed a scalable solution to enhance care delivery, expand specialty access, and improve financial performance.

Objectives

The hospital network aimed to:

- Reduce patient wait times and overcrowding

- Improve chronic disease management

- Expand specialty care to remote communities

- Reduce operating costs related to in-person consultations

- Increase patient satisfaction and continuity of care

Solution Implemented

1. Full Integration of Digital Health Technologies

The network adopted:

- Electronic Health Records (EHR) across all departments

- AI-based diagnostic support for radiology and pathology

- Remote patient monitoring (RPM) for chronic disease management

- Virtual appointment system for follow-up consultations

-

Automated patient flow and bed management systems

2. Telemedicine Expansion

Telehealth was used for:

- Routine consultations

- Chronic care follow-up (diabetes, hypertension, cardiology)

- Emergency triage and psychiatric support

- Post-operative check-ins

3. Smart Hospital Infrastructure

Investments were made in:

- IoT-enabled vital monitoring

- Digital command center for capacity management

- Hybrid operating rooms for advanced cardiovascular procedures

Key Results (Within 18 Months)

| Success Metric | Impact |

| Telemedicine adoption | Increased from 5% to 34% of all patient visits |

| Outpatient waiting time | Reduced by 41% |

| Inpatient bed turnaround time | Improved by 28% through automated bed management |

| Readmission rates | Dropped by 17% due to better remote monitoring |

| Cardiology department throughput | Increased by 23% through hybrid ORs and digital workflows |

| Operational cost savings | ~USD 68 million annually |

| Patient satisfaction score | Improved from 79% to 91% |

Reasons for Success

1. Strong Digital Integration

Using connected systems (EHR, telemedicine, AI diagnostics) minimized duplication of tasks and reduced medical errors.

2. Efficient Workflows

AI-powered triage and automated scheduling sped up clinic operations and improved provider efficiency.

3. Expanded Access for Remote Patients

Telemedicine removed geographic barriers and accelerated post-operative recovery monitoring.

4. Highly Trained Workforce

Doctors and nurses received digital-health certification to ensure smooth adoption.

Lessons for Healthcare Leaders

- Invest early in digital infrastructure — it reduces long-term operational costs.

- Telemedicine should complement—not replace—in-person care, especially for chronic disease management.

- AI improves diagnostic accuracy and workflow efficiency when combined with clinician oversight.

- Remote patient monitoring lowers readmissions, improving hospital performance scores.

-

Smart hospital technologies deliver measurable ROI, especially in emergency and cardiovascular care.

Why This Case Matters for the Global Market

This transformation demonstrates how digital health and telemedicine directly fuel the growth of the global hospital services market, supporting:

- Improved clinical outcomes

- Lower costs

- Higher patient throughput

- Enhanced accessibility

- Scalable care models in aging and high-disease-burden populations

This aligns with key market drivers highlighted in your report—making it highly relevant for readers, investors, and decision-makers.

Objectives

The hospital network aimed to:

- Reduce patient wait times and overcrowding

- Improve chronic disease management

- Expand specialty care to remote communities

- Reduce operating costs related to in-person consultations

- Increase patient satisfaction and continuity of care

Solution Implemented

1. Full Integration of Digital Health Technologies

The network adopted:

- Electronic Health Records (EHR) across all departments

- AI-based diagnostic support for radiology and pathology

- Remote patient monitoring (RPM) for chronic disease management

- Virtual appointment system for follow-up consultations

-

Automated patient flow and bed management systems

2. Telemedicine Expansion

Telehealth was used for:

- Routine consultations

- Chronic care follow-up (diabetes, hypertension, cardiology)

- Emergency triage and psychiatric support

- Post-operative check-ins

3. Smart Hospital Infrastructure

Investments were made in:

- IoT-enabled vital monitoring

- Digital command center for capacity management

- Hybrid operating rooms for advanced cardiovascular procedures

Key Results (Within 18 Months)

| Success Metric | Impact |

| Telemedicine adoption | Increased from 5% to 34% of all patient visits |

| Outpatient waiting time | Reduced by 41% |

| Inpatient bed turnaround time | Improved by 28% through automated bed management |

| Readmission rates | Dropped by 17% due to better remote monitoring |

| Cardiology department throughput | Increased by 23% through hybrid ORs and digital workflows |

| Operational cost savings | ~USD 68 million annually |

| Patient satisfaction score | Improved from 79% to 91% |

Reasons for Success

1. Strong Digital Integration

Using connected systems (EHR, telemedicine, AI diagnostics) minimized duplication of tasks and reduced medical errors.

2. Efficient Workflows

AI-powered triage and automated scheduling sped up clinic operations and improved provider efficiency.

3. Expanded Access for Remote Patients

Telemedicine removed geographic barriers and accelerated post-operative recovery monitoring.

4. Highly Trained Workforce

Doctors and nurses received digital-health certification to ensure smooth adoption.

Lessons for Healthcare Leaders

- Invest early in digital infrastructure — it reduces long-term operational costs.

- Telemedicine should complement—not replace—in-person care, especially for chronic disease management.

- AI improves diagnostic accuracy and workflow efficiency when combined with clinician oversight.

- Remote patient monitoring lowers readmissions, improving hospital performance scores.

-

Smart hospital technologies deliver measurable ROI, especially in emergency and cardiovascular care.

Why This Case Matters for the Global Market

This transformation demonstrates how digital health and telemedicine directly fuel the growth of the global hospital services market, supporting:

- Improved clinical outcomes

- Lower costs

- Higher patient throughput

- Enhanced accessibility

- Scalable care models in aging and high-disease-burden populations

This aligns with key market drivers highlighted in your report—making it highly relevant for readers, investors, and decision-makers.

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Hospital Services Market Regional Insights

How North America Dominated the Hospital Services Market?

North America dominated the market in 2024, due to the developed level of healthcare infrastructure and the main use of advanced medical technologies in North America. The U.S. is the leader of the region, and it enjoys a high-volume hospital network, increased demand for specialized care, and large healthcare spending.

The levels of government and private investment have given a boost to the use of new solutions like electronic health records (EHRs), robotic surgeries, and telemedicine to enhance the quality of care and operational efficiency. Moreover, the increasing tendency to consolidate hospitals and integrate the systems is enhancing patient outcomes, as the coordinated delivery of care is now possible.

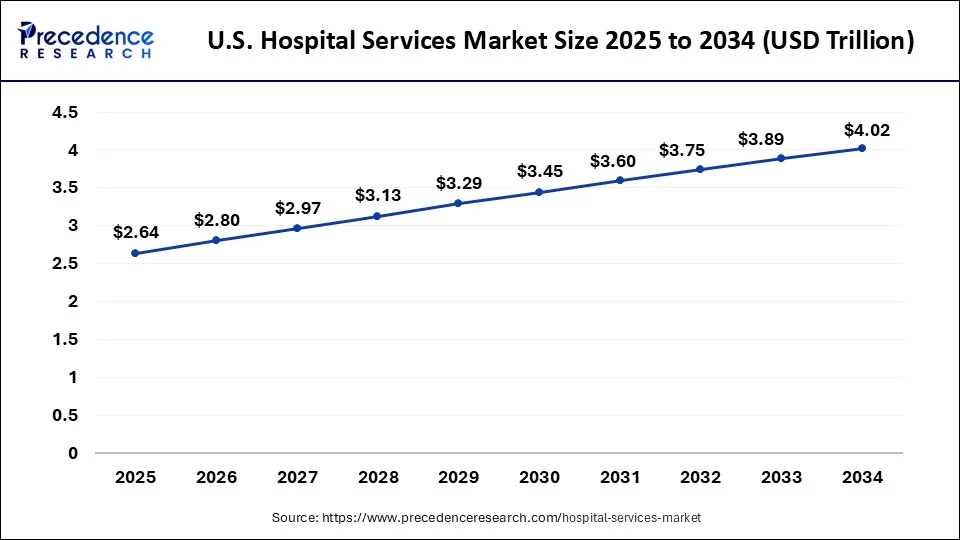

How Big is the U.S. Hospital Services Market?

According to Precedence Research, the U.S. hospital services market size is estimated at USD 2.64 trillion in 2025 and is projected to exceed nearly USD 4.02 trillion by 2034, with a strong CAGR of 6.69% from 2025 to 2034.

Key Drifts in U.S. Hospital Services Market:

- Hospital admissions remain elevated post-pandemic, with expected growth from 36 million in 2025 to 40 million by 2035.

- Staffed hospital beds have decreased, causing higher occupancy rates and potential capacity challenges.

- Hospital spending surged by over 10% year-over-year in 2023, driven by increased demand for medical procedures.

- Private health insurance enrollment grew significantly, leading to higher private insurance spending.

- Outpatient services have become the largest revenue segment, reflecting a shift toward less invasive care.

Note: This report is readily available for immediate delivery. We can review it with you in a meeting to ensure data reliability and quality for decision-making.

Try Before You Buy – Get the Sample Report@ https://www.precedenceresearch.com/sample/3708

U.S. Hospital Services Market Key Players

- Mayo clinic

- HCA Healthcare

- Cleveland clinic

- Ascension Health

- Community Health Systems, Inc.

- Tenet Healthcare

- MIT Health

- Universal Health Services

- Trinity Health

- Lifepoint Health, Inc.

Why is Asia Pacific the Fastest-Growing in the Hospital Services Market?

Asia Pacific experiences the fastest growth in the market during the forecast period. An ageing population is leading to an increase in the frequency of hospital-based solutions due to the increasing prevalence of chronic illnesses, including diabetes, cancer, and cardiovascular diseases. There is an immense investment by governments in the region in reforms in healthcare, insurance coverage, and improvement of hospital infrastructures to accommodate the growing healthcare demands.

China, in particular, is the key player in the creation of regional hegemony, with government-supported healthcare reforms, the use of digital health, and hospital modernization. Also, the increasing health awareness of the population and the acceleration of urbanization are contributing to the increasing demand for high-level hospital services.

Key Drifts in India Hospital Services Market:

- Hospital admissions are rising rapidly due to increasing population and growing chronic disease burden.

- Expansion of healthcare infrastructure is ongoing, but bed availability remains limited in rural areas.

- Healthcare spending is increasing steadily, driven by rising middle-class income and government initiatives.

- Growth in private health insurance penetration is boosting demand for quality hospital services.

- Outpatient and day-care services are gaining popularity, reflecting cost-conscious patient preferences.

- Telemedicine and digital health solutions are expanding access, especially in underserved regions.

Hospital Services Market Segmentation Insights

Hospital Type Insights

Why did the public/community hospitals Segment Dominate the Market?

The public/community hospitals segment dominated the market in 2024 because it is more accessible due to its affordability and ability to provide care to a wide range of patients. Philanthropic organizations, community funding, and corporate contributions usually enable the provision of much-needed healthcare services at reduced costs by the Public/community-based hospitals. They are usually the facility with the highest number of beds allocated and organized into specific departments, which serve a very broad scope of medical conditions, from general care to emergency care. Their focus on inclusiveness, affordability, and comprehensive coverage of healthcare which are important to the overall provision of care to the patients.

The private hospitals segment is the fastest-growing in the market during the forecast period. The market is showing a growing demand for advanced and specialized healthcare services, which are driving the rapid growth of the private hospitals segment in the market.

The attraction of patients to the private hospitals is rising because of their modern infrastructure, reduced waiting list, individualized care, and the introduction of modern technologies to them, including robot-surgeries and digital health-related packages. In addition, the rising medical tourism in countries such as India, Thailand, and Singapore is boosting the development of hospitals operated privately, since they provide quality services at affordable prices.

Service Type Insights

Which Service Type Segment Held the Largest Share of the Market?

The inpatient services segment held the largest share in the market in 2024 because of the necessity of long-term medical services, complicated operations, and complex treatment, which required a long period of hospitalization. This segment is still dominant as the hospitals dedicate a good part of their infrastructure, such as special wards, ICUs, and long-term care facilities, to attend to inpatients. Although inpatient services are still necessary in treating severe and chronic cases, they are challenged by outpatient services because of the increasing healthcare expenses and the insufficient insurance coverage.

The outpatient services segment experiences the fastest growth in the market during the forecast period, due to the increasing need for cost-effective yet convenient healthcare services. Outpatient treatments have gained more preference among many patients as they require discharge on the same day, and the cost of hospitalization is less than that of extended hospitalization.

Due to the improvement of surgical methods, minimally invasive surgery, and quick wound-healing solutions, the recovery time has also decreased greatly, which preconditions that outpatient services are more appealing. Moreover, the low insurance coverage of long-term inpatient care is driving patients towards outpatient options, especially in developed nations, which have expensive healthcare coverage.

Service Areas Insights

How Cardio-vascular Services Segment Dominates the Market?

The cardio-vascular services segment dominated the market in 2024, due to the world's rising cases of cardiovascular diseases, including coronary artery disease, hypertension, and stroke. The ever-rising demand for sophisticated treatment means, such as minimal invasive surgeries, angioplasty, and the next-generation stents, has largely augmented the dependency on cardiovascular services that are hospital-based.

Cardiac units are also being upgraded in hospitals with advanced diagnostic imaging systems, robotic-assisted and hybrid operating rooms, which are also being highly invested in to improve treatment outcomes.

The neurorehabilitation & psychiatry services segment is the fastest-growing in the market during the forecast period. Increasing rates of neurological diseases like Parkinson's, Alzheimer and stroke-related disability are increasing the demand for rehabilitation services. At the same time, increasing incidences of psychiatric disorders such as depression, anxiety, and substance abuse are forcing hospitals to increase their mental health care. The current progress of the neurorehabilitation methods, such as brain-computer interfaces, robotics-assisted methods, and rehabilitation using virtual reality, is further improving the treatment outcomes and therapy recovery of patients.

✚ Related Topics You May Find Useful:

➡️ Hospital Equipment and Supplies Market: Explore how smart devices and sterile technologies are reshaping global hospital operations

➡️ Healthcare IT Market: Track how digital transformation and interoperability are redefining modern healthcare systems

➡️ Hospital Information System Market: See how data-driven platforms improve clinical workflows, patient records, and hospital efficiency

➡️ Healthcare Staffing Market: Understand how workforce shortages and telehealth adoption are driving staffing solutions worldwide

➡️ Hospital Information System Market: Analyze advancements in EMR/EHR, analytics, and cloud technologies revolutionizing hospital management

➡️ Healthcare Facilities Management Market: Learn how integrated FM strategies are enhancing safety, sustainability, and patient experience

➡️ Healthcare Consulting Services Market: Discover how digital innovation, compliance needs, and operational optimization fuel consulting demand

➡️ Hospital Outsourcing Market: Evaluate how hospitals are reducing costs and improving service quality through specialized outsourcing

➡️ Acute Hospital Care Market: Gain insights into rising demand for emergency care, critical care technologies, and rapid treatment solutions

➡️ Healthcare Analytical Testing Services Market: Explore how stringent regulations and biopharma innovation are boosting analytical testing needs

➡️ Healthcare Software as a Service Market: See how cloud-based software is accelerating scalability, security, and healthcare digitalization

Top Companies in the Hospital Services Market

- Mayo clinic

- HCA Healthcare

- Cleveland clinic

- Spire Healthcare Group plc

- Ramsay Health Care

- Ascension Health

- Community Health Systems, Inc.

- Tenet Healthcare

- Fortis Healthcare

Recent Developments

- In January 2025, Kauvery Hospital, India, launched a new community clinic at Express Avenue, and it would be aimed at providing high-quality healthcare services. The facility will be able to serve both the population and those in the Express Avenue so that quality care is readily accessible. Source: https://healthcareasiamagazine.com

- In January 2025, SPARSH Hospitals opened its state-of-the-art fertility care center in Bangalore, India, which will be fitted with state-of-the-art technology. The program will provide advanced, caring, and high-quality fertility care. Source: https://www.newindianexpress.com

- In June 2024, the University of Alabama at Birmingham (UAB) collaborated with Whitefield Regional Hospital in the opening of the first expanded hospital in Alabama with a Tele-ICU. This partnership will boost the capacity of UAB to provide Tele-ICU services and foster evidence-based practice. Source: https://www.uab.edu

Segments Covered in the Report

By Hospital Type

- State-owned Hospital

- Private Hospital

- Public/ Community Hospital

By Service Type

- Outpatient Services

- Inpatient Service

By Service Areas

- Cardiovascular

- Acute Care

- Cancer Care

- Diagnostics and Imaging

- Neurorehabilitation & Psychiatry Services

- Gynecology

- Others

By Regional

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia Pacific

- China

- India

- Japan

- South Korea

- Rest of the World

Thank you for reading. You can also get individual chapter-wise sections or region-wise report versions, such as North America, Europe, or Asia Pacific.

Immediate Delivery Available | Buy This Premium Research Report@ https://www.precedenceresearch.com/checkout/1082

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 804 441 9344

Stay Ahead with Precedence Research Subscriptions

Unlock exclusive access to powerful market intelligence, real-time data, and forward-looking insights, tailored to your business. From trend tracking to competitive analysis, our subscription plans keep you informed, agile, and ahead of the curve.

Browse Our Subscription Plans@ https://www.precedenceresearch.com/get-a-subscription

About Us

Precedence Research is a worldwide market research and consulting organization. We give an unmatched nature of offering to our customers present all around the globe across industry verticals. Precedence Research has expertise in giving deep-dive market insight along with market intelligence to our customers spread crosswise over various undertakings. We are obliged to serve our different client base present over the enterprises of medicinal services, healthcare, innovation, next-gen technologies, semi-conductors, chemicals, automotive, and aerospace & defense, among different ventures present globally.

Web: https://www.precedenceresearch.com

Our Trusted Data Partners:

Towards Healthcare | Towards Packaging | Towards Automotive | Towards Chem and Materials | Towards FnB | Towards Consumer Goods | Statifacts | Towards EV Solutions | Towards Dental | Nova One Advisor | Market Stats Insight | Nutraceuticals Func Foods | Onco Quant | Sustainability Quant | Specialty Chemicals Analytics

Get Recent News:

https://www.precedenceresearch.com/news

For the Latest Update Follow Us:

LinkedIn | Medium | Facebook | Twitter

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.